Occasionally shivers go up my spine when a financial commentator suggests that, rather than taking a bank’s Term Deposit rates, people should consider buying the actual shares in the bank (as the share’s dividend yield is much higher and tax-advantaged).

For example, “I only have to look at the facts to see it makes more sense to invest in bank shares…. buying and selling bank shares is a better strategy than parking your money in a term deposit and someone else (the bank) using it”. (Let’s not put a name to this commentator)

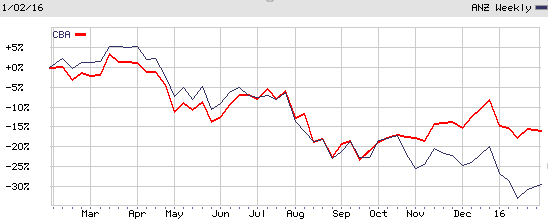

If you seek risk-free security that ensures all your capital will be returned to you, then this bank ownership strategy isn’t the right choice. If you placed $100k into ANZ shares last year, instead of the term deposit you were anticipating, you now only have $64k. If it was CBA shares it would be worth $77k – that’s logic with a real kick in the tail. You’d happily swap your shares for that term deposit now!

As bank shares have now dropped, the dividend yield (% of the share price) is going to look even higher in comparison. So it’s quite likely we will again hear someone suggest that bank ownership is smarter than having a term deposit – but don’t be fooled. The notion that our Big4 banks are immune from a sustained downturn is wrong, as no industry is immune from changes that damage their current model.

It’s all about knowing the purpose of your funds. If you need the capital back in the short/medium term, then it needs to be very safely invested. If it’s for your retirement in 20 years, then shares are a good option