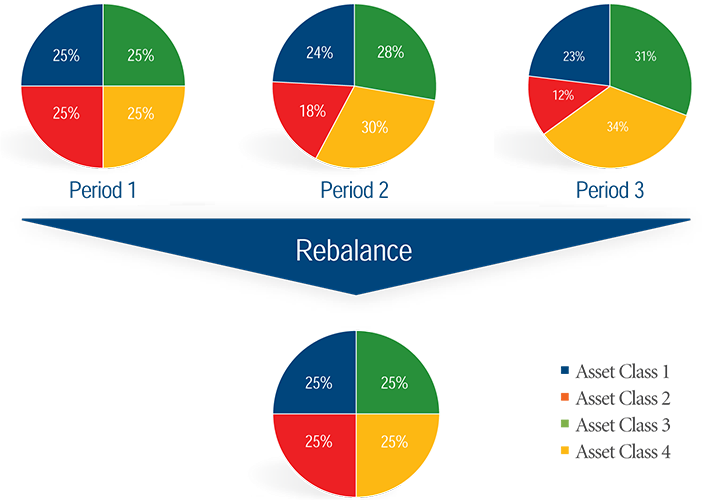

‘Portfolio Balancing’ happens to funds behind the scenes and is worth understanding. Here is a simple example to demonstrate –

Let’s say you have lump to invest and you want it kept equally in four different assets. After a couple of years the chances are these assets would have had quite different performances and no longer reflect your original asset mix. But that in itself is not the big problem.

The real issue is that these asset classes take turns at being good performers; whatever did badly before, is now cheaper in comparison, thus closer to taking its turn to be the star performer. So it’s possible in the next two years the performances will be reversed. If that happens you would obviously want more money in the assets that are about to do well. Unless you make some changes, the majority of your money would be sat in the assets that may now go quiet.

What rebalancing does for you is to take some money out of the star and inject it into the cheaper asset that hasn’t done so well. So if you simply ‘rebalance’ the split regularly back to the original mix, in a simple way you have done exactly what all the investment books encourage you to do – Buy low, Sell high.